Part 3: How We Got Here – the Panic of 1907

April 14, 2021

In 1907, a small group of wealthy speculators attempted to corner the U.S. copper market, but their plan backfired. The price of United Copper stock crashed and their loans were called. They didn’t have the cash, so they were forced to sell additional securities. This caused a drop in the overall market spooking other investors who joined the selling.

To compound the problem, one of these men was president of a bank and two of the other copper speculators were directors. (These men were involved in eight banks.) Depositors began withdrawing money. A panic ensued and spread to other banks.1

“Fear and suspicion settled in. Depositors distrusted banks. Banks distrusted each other. The perfect ingredients for a crisis coalesced… Moreover, as in all times of financial uncertainty, money ceased flowing. Scared investors dumped more stocks into declining markets… The collapse of confidence [continued as] rumors of unsoundness abounded.”2

The New York banking elites, lead by J.P. Morgan and his cohorts, flush with bailout deposits provided by the U.S. Treasury, stepped in the save the day and restore order to the markets. “The New York Times later ran a spread on Morgan titled, ‘John Pierpont Morgan, a Bank in Human Form,’ glowingly recapping all the tactics he had deployed to keep the financial system from crumbling.”3

But the truth is that Morgan used the crisis to purchase the Tennessee Coal and Iron Company for his U.S. Steel. Also, Morgan and his circle of New York banking elites charged smaller banks substantial rates of interest for funds that had been provided to the Morgan group at virtually no interest by the U.S. Treasury.

Unfortunately, the partnership of the Treasury and the titans of finance did not solve the problem. “All the while, small businesses around the country were unable to get funds because the government’s resources were being used to relieve stock gamblers and to assist the Morgan banks.”4

“Banks in small towns continued to limit the money that depositors could extract. The West [was unable] to pay for crops. Across the country, manufacturing, wholesaling and retailing were affected by the lack of money flow.”5

The bank panic caused by speculators, and left unresolved by the actions of the New York banking cartel, had created a national recession. People throughout the country suffered while the major banking houses profited. Yet for the financial elites, this short-term profit was not enough. The run on the banks had exposed the fragility of the financiers’ great wealth generating system. They could not always rely on the government to willingly raid the U.S. Treasury to bail them out.

What was needed was a protectorate who would always prioritize the banks’ interests. This would require a strong currency that the financial elites could control, the continued concentration of money in the major New York banks, and access to emergency bailout funds whenever needed. The answer was the creation of a national Central Bank.

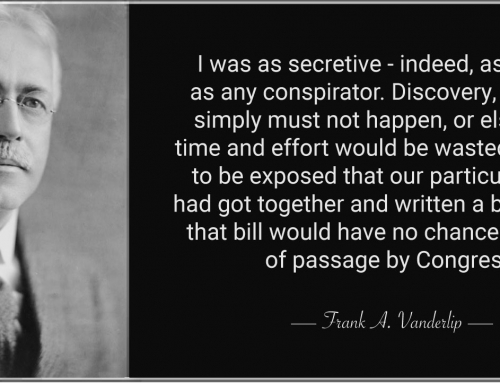

The Panic of 1907 proved to be just the crisis they needed to justify the creation of an institution that could ensure the continued increase of their wealth and power, and provide a safety net whenever their excesses caught up with them. The solution would be conceived in secret as the Wall Street elites, along with their allies in Washington, developed a plan.