Part 9: Inflation Blame-Shifting Continues

October 26, 2021

The reality of inflation has forced its way into our daily economic conversation. For months the official narrative of the Federal Reserve and our political leaders has been to reassure the public that there is no need to be overly concerned about rising prices. “Inflation is transitory,” they repeat confidently. “It is a temporary phenomenon of supply foul-ups and shortages caused by a booming recovery from the pandemic.”

The reality of inflation has forced its way into our daily economic conversation. For months the official narrative of the Federal Reserve and our political leaders has been to reassure the public that there is no need to be overly concerned about rising prices. “Inflation is transitory,” they repeat confidently. “It is a temporary phenomenon of supply foul-ups and shortages caused by a booming recovery from the pandemic.”

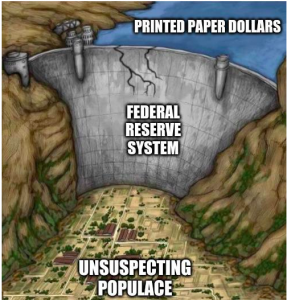

But actual inflation is not caused by supply chain problems. Rather, it is a monetary phenomenon caused by the excessive creation of new currency and credit by governments. https://case4america.com/part-8-exposing-the-governments-inflation-narrative-as-political-fraud/

Jerome Powell, Chairman Federal Reserve

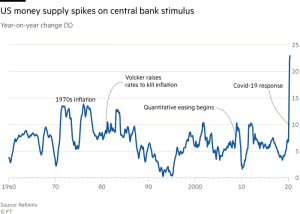

Just as U.S. political leaders in the 1970s tried to shift the responsibility for high inflation away from their monetary policies, those running the show now are also attempting to blame rising prices on circumstances they claim are beyond their control. They also assert that these market distortions will soon correct and price increases will naturally subside – thus, their “transitory” explanation.

But to effectively stop inflation from devastating the economy, one must have an accurate understanding of a realistic cure based on the actual cause. Part of the problem stems from the common use of the word inflation to describe rising prices, regardless of what causes the increases. Market disruptions can result in price increases for any number of reasons. But only the corruption of a nation’s currency by excessive money creation can cause “inflation” which is the general increase in the price of all goods and services at the same time.

Popular scapegoats advanced by the inflation blame-shifters include disruptions in supply chain manufacturing from Asia as well as the shortage of cargo ships, containers, loading facility labor and freight delivery trucks. Also, many commodities have experienced higher prices due to circumstances other than monetary inflation.

For example:

-

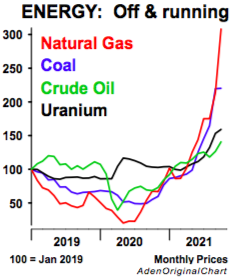

Energy (e.g., natural gas, oil and coal) caused by climate policies

-

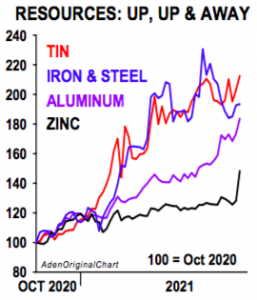

Natural resources (e.g., copper, tin, aluminum and zinc) caused by regulations, higher energy costs and the lack of investment in new mines

-

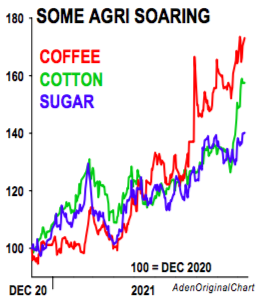

Agriculture (e.g., coffee, cotton and grains) caused by bad weather and higher fertilizer costs.

It is true that unanticipated circumstances can result in demand and supply imbalances causing prices to rise. And it is also true that when the market rebalances, these specific pricing pressures generally subside.

But veiled behind these supply chain disruptions is the growing reality of monetary inflation. The economic destroyer of unimagined amounts of money creation has been released from the abyss and there is growing public awareness that a day of reckoning is fast approaching.

Over 20% of the total U.S. money supply was created in the past 18 months.