Commentary: Housing – Will the Unsustainable be Sustained

September 9, 2021

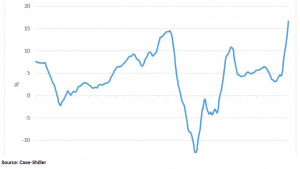

Housing prices have increased 19% over past year.

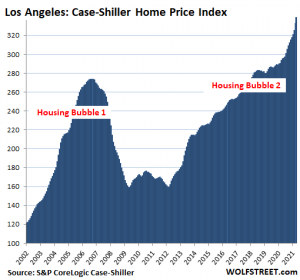

Some housing experts anticipate an imminent crash in housing prices.Fox Business states that “the euphoria in the U.S. housing market may be flashing a danger signal, and lofty home values could be at risk of a sharp drop.”[1]

Some housing experts anticipate an imminent crash in housing prices.Fox Business states that “the euphoria in the U.S. housing market may be flashing a danger signal, and lofty home values could be at risk of a sharp drop.”[1]

National Association of Home Builders CEO Jerry Howard says new home construction data is showing similarities to the 2008 housing market crash.[2]

According to David Rosenberg of Rosenberg Research, the collapse of U.S. home prices is inevitable when considering “all the fundamental factors that drive valuations.” He believes that home prices are 25% overvalued compared with residential rents, almost 50% above normalized levels when factoring in inflation and more than 25% overvalued versus income measures like the employment cost index.[3]

Also quoted to reinforce the proposed collapse of housing prices is the University of Michigan’s July consumer survey that found that only 30% of the public thought home buying conditions were favorable.[4]

Of course, who would call home buying a “favorable” experience when you spend days looking at real estate, find the home of your dreams, make an offer at the asking price and then find out that 20 other hopeful home buyers have already made an offer for more than the asking price.

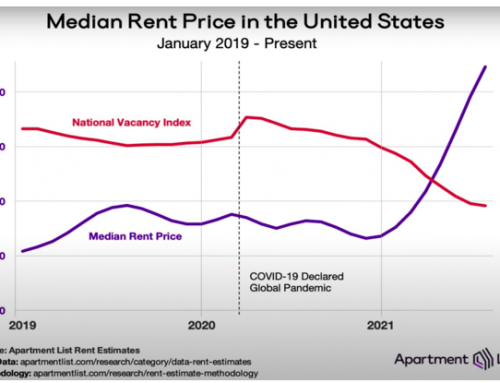

Stories like this are endless. We’ve even heard of buyers offering to pay the seller’s closing costs and moving expenses. This is not a sign of an impending real estate crash, but rather of massive amounts of liquidity fueled by historically low interest rates and endless government stimulus. The Federal Reserve and the U.S. government have flooded America with trillions of dollars, and in this particular case, the money is literally seeking a home.

The red-hot housing and rental markets may cool slightly to become just hot markets. Prices may vary with interest rates occasionally rising slightly. There will undoubtedly be inventory adjustments and increases in new home and apartment construction. But we now live in the monetary world of the Federal Reserve where aberrations such as the real estate crash of 2006-2008 will most likely be no longer permitted to occur.

The red-hot housing and rental markets may cool slightly to become just hot markets. Prices may vary with interest rates occasionally rising slightly. There will undoubtedly be inventory adjustments and increases in new home and apartment construction. But we now live in the monetary world of the Federal Reserve where aberrations such as the real estate crash of 2006-2008 will most likely be no longer permitted to occur.

The rate of inflation will fluctuate at times, so prices may not continue to increase as rapidly as they have this past year. But as we have learned from past experience, any serious threat of deflation and a crash of home prices, or any other asset values, will be greeted by the Fed with whatever flood of liquidity is needed to re-inflate the bubble. In this way, what should be unsustainable will be sustained for years to come. Such is the nature of politically-driven monetary inflation.

[1] https://www.foxbusiness.com/economy/housing-black-swan

[2] Ibid

[3] Ibid

[4] Ibid