Commentary: Once Again the Democrats’ “Tax the Rich” Means Taxing the Middle Class

September 27, 2021

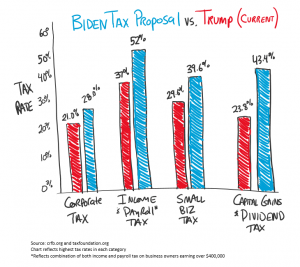

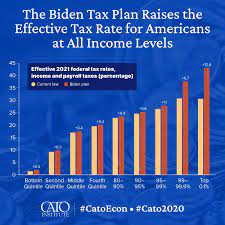

The Democrats are on the hunt for a fresh source of tax revenue to pay for their dream of a utopian super-state. What politicians undoubtedly know, but fail to mention, is that the “rich” they claim to be targeting have a hundred-and-one ways to avoid becoming piggy banks for would-be socialist wealth redistributors like Joe Biden, Elizabeth Warren, Bernie Sanders and their “leftist” cohorts.

Joe Biden is continuing the D.C. long-practiced tradition of political deception with his most recent effort to “tax the rich” and make them pay their fair share, and thereby achieve their supposed goal of income equality. This is nothing new. One historical example that the Democrats are emulating occurred in 1913 when Congress approved the Federal Income Tax. The public was promised that the income tax would only apply to the rich, but within a few years it included everyone.

Joe Biden is continuing the D.C. long-practiced tradition of political deception with his most recent effort to “tax the rich” and make them pay their fair share, and thereby achieve their supposed goal of income equality. This is nothing new. One historical example that the Democrats are emulating occurred in 1913 when Congress approved the Federal Income Tax. The public was promised that the income tax would only apply to the rich, but within a few years it included everyone.

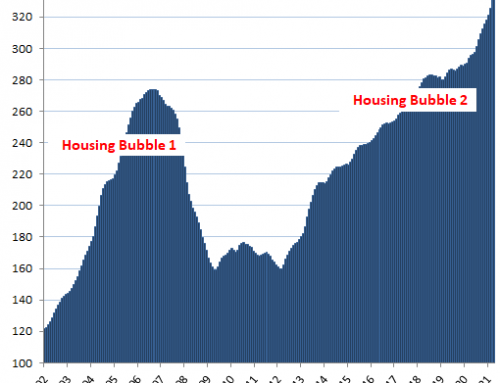

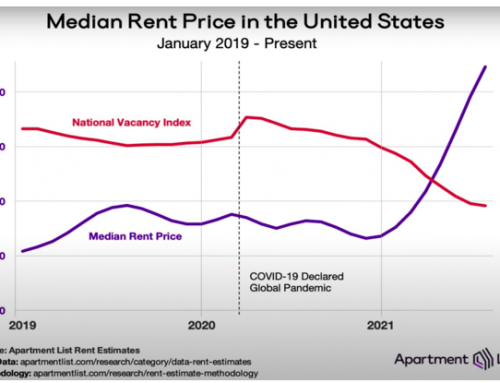

Currently, the first egregious proposal the Democrats are attempting to inflict on the American middle class is to discontinue the “stepped-up basis.” The Left claims they will be closing a tax loophole for billionaires, but their proposal is actually a tax increase aimed at middle class homes, farms and businesses. Stepped-up basis saves heirs from paying taxes on price increases that are caused by inflation by resetting the property’s current value each time it is inherited. The way it is presently done, according to stepped-up basis, is that the capital gains tax is paid only when the inheritor actually sells the property and pays tax only on the amount of gain realized by the inheritor from the time they took possession of the property.

presently done, according to stepped-up basis, is that the capital gains tax is paid only when the inheritor actually sells the property and pays tax only on the amount of gain realized by the inheritor from the time they took possession of the property.

In other words, according to the American Institute for Economic Research (AIER), “Under long-established law, an heir owes capital gains taxes when the heir sells, not inherits, assets. So, a family home, farm, or business, passed down from generation to generation, only creates a tax liability when… the heir sells it. Even then, the heir only pays tax on the increased value from when it was inherited.”1

The Democrats want to eliminate stepped-up basis and force heirs to be liable for capital gains taxes that would be figured from the time the asset was originally purchased. In the case where the family home, farm or business was passed down through several generations, this would make the capital gains exorbitant because it would not take into account decades of inflation.

The second part of the Democrats plan would create a middle class disaster. They want to require the heirs to pay the tax when they inherit the assets, not when they sell them. “So rather than the family home, farm, or business being taxed when the heir sells, it would be taxed each time it moves from one generation to the next.”2 If this proposal becomes new tax law, it will be extremely difficult to build and pass on generational businesses and wealth.

“The Democrats tax plan is a death tax on the working class dressed up as a capital gains tax on the rich.”3

As Americans have seen many times before, the deceitful political promises of “taxing the rich” seldom affect the rich and are always eventually paid by the middle class. Biden has offered up a bucket of exemptions to placate the naive who once again believe that this time it will be different and the promises of the Federal Government can be trusted. But it won’t be different. Once the taxes are in place, the exemptions will begin to disappear. That’s the way it works. That’s the only guarantee.

As Americans have seen many times before, the deceitful political promises of “taxing the rich” seldom affect the rich and are always eventually paid by the middle class. Biden has offered up a bucket of exemptions to placate the naive who once again believe that this time it will be different and the promises of the Federal Government can be trusted. But it won’t be different. Once the taxes are in place, the exemptions will begin to disappear. That’s the way it works. That’s the only guarantee.

The Biden plan is so blatant in its attack on inherited property that one must conclude that the elimination of inherited property and businesses is their ulterior motive.