Commentary: Soaring Home and Rent Prices

September 6, 2021

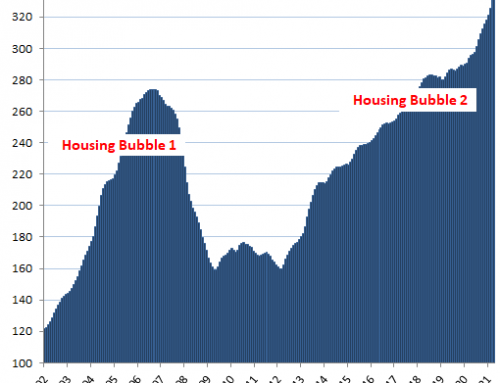

A recent headline on CNBC read: “Soaring home prices shattered another record in June.”[1] Fox Business reported, “U.S. home prices accelerated at a record pace for the third consecutive month in June. Homebuyers bid up prices 18.6% year over year, the fastest on record, according to the national Case-Shiller index. Prices are now 41.3% above their 2006 peak.”[2]

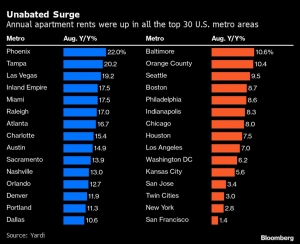

The Case-Shiller Core-Logic 20-City composite recorded a 19.1% increase over the past year. Phoenix gained the most with a price increase of 29.3%, San Diego followed at 27.1% and then Seattle at 25%. Only Chicago failed to achieve a new record.

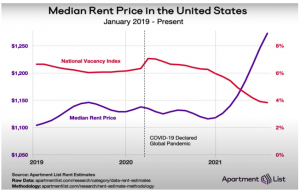

Rents are not far behind housing having risen 14% since January.

Is the United States headed for another 2006-2008 housing crisis? We’ll have to see. We no longer have subprime mortgages and bank loans given to people without credit or jobs. Anyone who has experienced the current inquisition by the banks of those presently attempting to acquire a mortgage loan can attest to this fact.

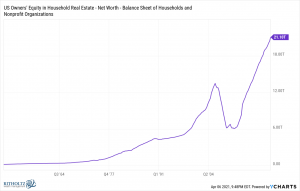

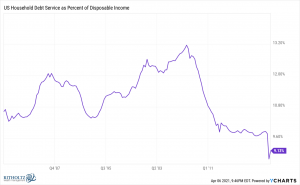

Prices may stabilize, but the next two charts show why there is much less chance of a housing crash like 2008:

US Homeowners’ Equity:

US Household Debt as % of Income:

Mortgage interest rates, currently around 3%, are certainly a driving force in the housing market contributing to strong demand and low inventory. Also the increased cost of materials and skilled labor has limited the construction of new homes, thereby constricting inventory. This shortage of housing has also resulted in a dramatic increase in rents as well. But whatever the cause, there is much agreement that the price increases of basic shelter are out of control and cannot be sustained.

This leads to the obvious question: Why does the Federal Reserve continue to suppress long-term interest rates at artificially low levels? And secondly, why does the Fed continue to buy 40 billion dollars of mortgage-backed securities every month when housing is booming, unemployment is falling, and the economy is rolling along at 6.5% GDP.

The Federal Reserve’s monetary policies and actions are the primary driver of the housing market including rent pricing in the U.S. economy. To anticipate the future housing and rent costs, watch what the Federal Reserve does with future interest rates and bond purchases.

[1] https://www.cnbc.com/2021/08/31/home-prices-surged-in-june-shattering-another-record-sp-case-shiller-says.html

[2] https://www.foxbusiness.com/economy/case-shiller-home-price-index-june-2021